The earliest tax list in Pennsylvania was made at Penn’s request so that he would know what quitrents he was entitled to. People who bought or rented land from him were obligated to pay a certain amount per year, depending on how many acres they had and the terms of their purchase. First Purchasers paid a shilling for every hundred acres; servants paid more (but got their 50 acres for free); people who got extra land for bringing servants paid even more. Before Penn’s arrival the Swedes had been accustomed to paying their rents in produce such as bushels of wheat, but Penn insisted on payment in currency. Currency was scarce in early times and this caused some resentment. 1 Penn complained in 1686 that he received none of his rents.

To remedy this, in 1689 he appointed John Blackwell, who had stepped down as deputy governor, as the receiver general. Blackwell was supposed to direct the sheriffs to collect the taxes in their counties, but soon found that there was no accounting system set up for this. He started by making a rent-roll, the first list of who lived in each county and how much land they owned. His list has survived for Chester County and Philadelphia County (and city), but not Bucks County. 2

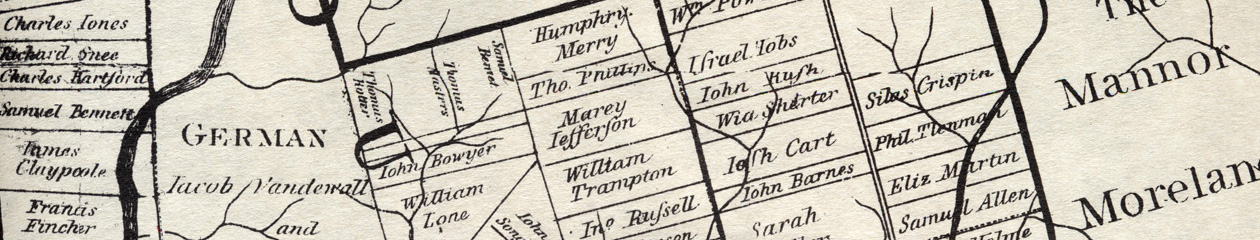

Blackwell’s list is organized by block (in the city) and township (in the counties). Each entry includes the name, status (such as Old or Purchaser,), the quitrent, and the number of years the rent was due. Because Blackwell listed the people who were actually living on the land, as opposed to absentee owners, it is a good indication of who emigrated. However it does not include laborers, servants or others who were not responsible for the rent.

The earliest true tax was levied in 1693, controversial because it was partly intended to pay for the expenses of New York in defense against the French. For the Quakers of Pennsylvania paying for war in any form was against their pacifist principles, but the Assembly finally approved the tax under the bland rationale of “support for the government”. 3 The amount levied was one penny per pound of assessed value of real and personal estate, or six shillings for freemen (non-servants) who did not own real estate. People were not to be taxed if they had “a great charge of children” or were indigent.

The lists made by the Collectors and Assessors have survived and are available in various places. The list for Philadelphia city and county was published in the Pennsylvania Magazine of History and Biography, volume 8. The list for Chester County was published in Futhey and Cope’s History of Chester County, while Bucks County was published in McNealy and Waite, Bucks County Tax Records 1693-1778. The original lists are in the manuscript holdings of the Pennsylvania Historical Society.

These lists are valuable for several reasons. They show who was living in a particular place in 1693. They show how much land they owned. And most important they give a picture of the wealth of time. You can look at the list and see the richest men in each county or the five richest men in the city. For the family historian or economic historian these are a valuable data source to be mined.

- Donna Munger, Pennsylvania Land Records, p. 34. ↩

- Hannah Benner Roach published the list for the city; it is included in Colonial Philadelphians. Mary Maples Dunn and Richard Dunn published the full list in their Papers of William Penn, volume 3. ↩

- William Rawle, Introduction to “The First Tax List for Philadelphia County”, PA Mag of History & Biography, vol. 8. ↩